According to a recent report released by S&P CoreLogic Case-Shiller, home prices in the United States have continued to rise in January 2023 for some parts of the country while others show a decline. The report shows that the national home price index increased by 18.2% year over year, up from the previous month’s growth rate of 18.1%. This surge in home prices is attributed to various factors such as low-interest rates, high demand, and low housing supply, sellers having interest rates below 3% not

January 2023 for some parts of the country while others show a decline. The report shows that the national home price index increased by 18.2% year over year, up from the previous month’s growth rate of 18.1%. This surge in home prices is attributed to various factors such as low-interest rates, high demand, and low housing supply, sellers having interest rates below 3% not![]() wanting to sell, leading to bidding wars and high competition among buyers.

wanting to sell, leading to bidding wars and high competition among buyers.

However, despite the increase in home prices, the US housing market has been witnessing a crash and soaring at the same time, as reported by Business Insider. While the demand for homes is high, there is a shortage of available houses in the market, leading to a surge in prices. Simultaneously, the rising mortgage rates have resulted in many potential homebuyers being unable to afford to purchase a home. “2023 began as 2022 had ended, with U.S. home prices falling for the seventh consecutive month,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite declined by 0.5% in January, and now stands 5.1% below its peak in June 2022″.

February 2023 saw the market capitalization of new homes sold in the U.S. rise for the first time in eleven months. A combination of a higher number of new homes sold and a small increase in the average sale price of new homes sold contributed to the first increase in this measure since March 2022.

“Florida was the best-performing state in January with multiple cities outperforming the rest of the country, extending its winning streak to six consecutive months averaging +10.5%, Atlanta GA (+8.4%) in third place, with Charlotte (+8.1%) not far behind. At the other end of the scale, one of the most interesting aspects of January’s report is the continued weakness in home prices on the West Coast, as San Diego, Portland, San Francisco & Seattle are in the negative year-over-year territory. It’s therefore unsurprising that the Southeast (+10.2%) continues as the country’s strongest region, while the West (-1.5%) continues as the weakest.”

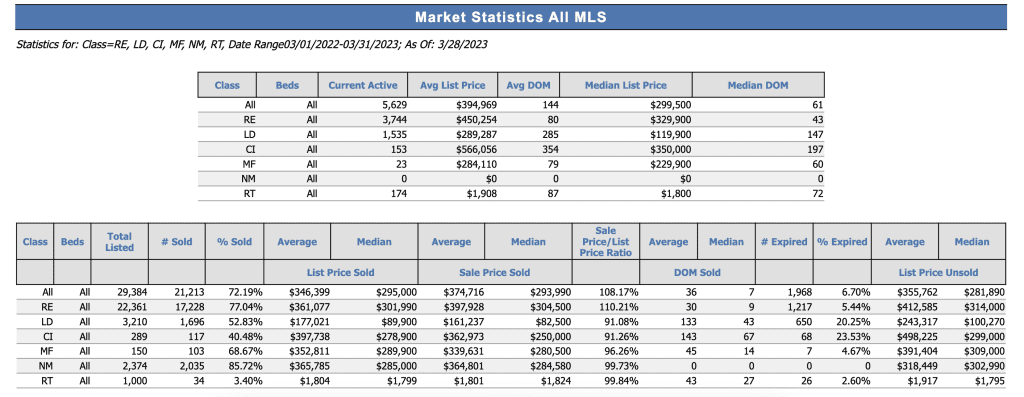

In South Carolina, the housing market has been experiencing similar trends. According to data from Zillow, the median home value in South Carolina is $214,138, representing a year-over-year increase of 17.9%. The state has seen a surge in demand for homes as many people have migrated to the state, looking for affordable housing options, good quality of life, and employment opportunities. Despite the high demand, South Carolina has been struggling to keep up with the supply, leading to an imbalance in the market.

Greenville, SC the 2nd highest-priced and most active market in South Carolina only behind Charleston SC real estate trends and housing stats.

The rising home prices have resulted in affordability challenges for many South Carolinians. According to a report by the National Low Income Housing Coalition, a South Carolinian earning the state’s median income would have to spend over 30% of their income on housing, making it difficult for many people to afford a home.

In conclusion, while the US housing market has seen a surge in home prices, the market is facing a crash and soaring at the same time depending on the city you’re looking to buy or sell in. South Carolina is experiencing similar trends, with high demand, low supply, and affordability challenges. The state must focus on increasing the housing supply and addressing affordability issues to ensure sustainable growth in its housing market.