Investment properties for sale in South Carolina MLS real estate property listings & investment property helpful information. There are different kinds of real estate investing that many people target, but the most common in South Carolina is probably “vacationer” investments. Developers, REITs, and hotel hedge fund managers spend millions if not billions on buying and developing hotels on the coast of SC and nowhere more than in Charleston SC especially. The last time I drove downtown Charleston I think I saw 6 or more cranes on the skyline building which are more than likely luxury hotels and/or apartments.

Columbia MultifamilyProperties Charleston MultifamilyProperties Greenville MultifamilyProperties Myrtle Beach MultifamilyProperties Commercial Properties Columbia Mobile Home ParksFor SaleIn the coastal communities of Myrtle Beach, Folly Beach, Kiawah Island, Edisto, Isle of Palms, Surfside, Pawley’s Island, Seabrook Island, Hilton Head, and Edisto most of the investment in real estate is usually going to be in the form of condos, townhouses and single-family home for weekly and nightly rental to tourists.

So, now you have to ask yourself (if you’re not a seasoned investor) what makes a good investment?

There are two commonly utilized methods of real estate investing (let’s call it 101). There are a lot of different factors that go into buying a rental property, second/investment home property, and since most people in SC buy a condo let’s start there. The first one is the carrying costs: mortgage payments, regime fees, HOA fees, taxes, and insurance will apply to pretty much any residentially zoned property (detached houses usually won’t have a regime fee most of the time), but the others will definitely apply.

Financing Investment PropertiesMortgagesThe expenses (carrying costs) are the costs to “carry or hold” the property. Beachfront condos in SC are the most popular things people seek out when looking for a second home they want to also rent out to tourists, but condos, villas, and townhouses (pretty much the same thing) all have regime (sometimes called HOA fees), that can and usually fluctuate. In Wild Dunes resort, Litchfield By The Sea, Kiawah Island, & Seabrook Island all gated golf resorts there is a community POA (property owners Assoc) dues, and if you buy an attached property there are ALSO monthly or quarterly regime fees. Regime fees usually pay for the maintenance, and upkeep of the amenities and exterior of the development as well as the required insurances. With the exception of interior policies.

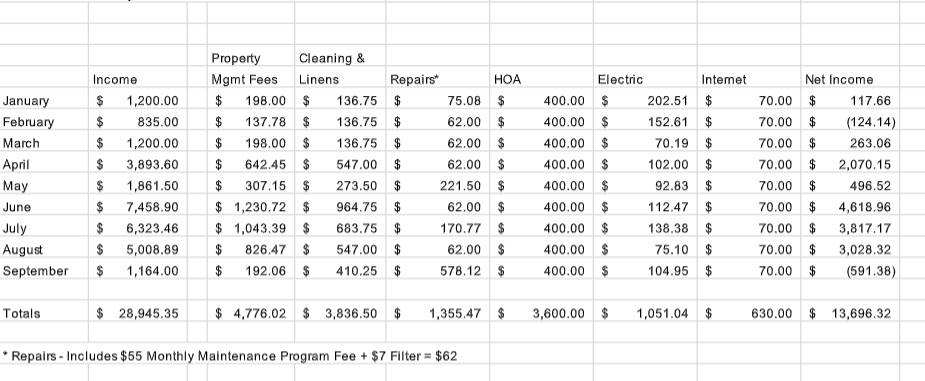

LET’S LOOK AT A 2 BEDROOM CONDO ON ISLE OF PALMS SC in Charleston..

MOST COMMON INVESTMENT PROPERTY METHODOLOGIES

The One Percent Rule –

The one-percent rule is simply a rule of thumb that investors use to help them narrow down their options quickly and efficiently. It’s a tool that you can use to determine if a property deserves a closer look. All the one-percent rule says is that a property should rent for one-percent or more of its total upfront cost. Keep in mind that this rule looks at a property’s total upfront cost, meaning that you’ll have to add together the purchase price, plus closing costs, and an estimate of the total repair costs necessary to make it marketable to rent. This method will be what most average buyers will want to use.

For Instance:

- A property that costs $100,000 should rent for at least $1,000 per month

- A property that costs $200,000 should rent for at least $2,000 per month etc.

SO.. The Oceanside condos example above was listed for $395,000 and probably would go under contract at $375,000. Using the 1% rule that means you’d have to get at least $3800 per month in rental income. That condo will gross $40,000 a year with a good rental program. The variables one has to consider are: how many times do you/owners use it, when do they use it?, and how much is the management company take for fees if you’re not going to self-manage with say Airbnb or VRBO?

* (So a $200,000 property that needs $50,000 in work would need to rent for at least $2,500 per month to make sense, not $2,000.)

If a property passes the one-percent rule, it’s worth considering. If not, move on to another property. At this point, it’s worth setting up showings for the properties that meet this rule’s criteria.

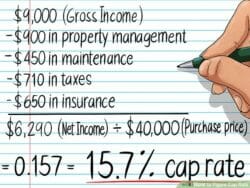

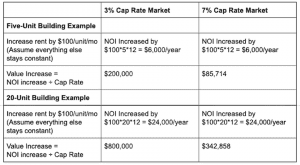

The Cap Rate Rule – (present value of future income)

Using this method is really commonly used for multifamily properties , commercial properties, and even mobile home parks more than anything since there are many more factors to consider when buying an apartment complex or quad-plex.

Using this method is really commonly used for multifamily properties , commercial properties, and even mobile home parks more than anything since there are many more factors to consider when buying an apartment complex or quad-plex.

Cap Rate = Net Operating Income ÷ Value

The cap rate is found by dividing the property’s net operating expenses by its purchase price. You can find the cap rate by doing the  following:

following:

- Find your gross income (rental rolls) by taking the average monthly rent for your property and multiplying it by 11.5. This will show the maximum amount you can make from the property, allowing for a two-week per year vacancy.

- Then, subtract your monthly operating expenses ( utilities, taxes, maintenance) from your gross income to get your net income. * The cap rate assumes you’ve bought the property in cash

- Divide your net income by the purchase price to find your cap rate.

- Multiply the cap rate by 100 to find the percentage of your potential returns on the property.

Make sure not to include a mortgage payment, if you have one make sure to include in your list of monthly operating expenses. Since every investor will use a different combination of down payment and financing, and by doing this will allow you to more easily compare one property’s ROI to another.

Cash on Cash Rule –

Calculating the Cash-on-Cash Return

For real estate, cash-on-cash return measures the annual return the investor made on the property in relation to the down payment only and is calculated as:

Cash-on-cash return only uses an investment property’s pre-tax inflows received by the investor and the pre-tax outflows paid by the investor. For example, suppose a real estate investor invests in a piece of property that does not produce monthly income. The total purchase price of the property is $1 million. The investor pays $100,000 cash as a down payment and borrows $900,000 from a bank. Due are closing fees, insurance premiums, and maintenance costs of $10,000, which the investor also pays out of pocket.

So, after 1 year, the investor has paid $25,000 in loan payments, of which $5,000 is principal repayment. Then Mr. investor decides to sell the property for $1.1 million after year one. This means the investor’s total cash outflow is $135,000, and after the debt of $895,000 is repaid, he is left with a cash inflow of $205,000. The investor’s cash-on-cash return is then: ($205,000 – $135,000) / $135,000 = 51.9%.