Buying a home or condo as an investment property in Myrtle Beach, South Carolina, can be a lucrative opportunity, but it’s important to carefully consider the pros and cons before making the investment. South Carolina is full of investment opportunities, not just Myrtle Beach, but the coastal Grand Strand from Pawley’s Island all the way up to Cherry Grove has so much real estate, it gives investors a lot of options. There are condos, low-rise, mid-rise, and high-rises, along with luxurious oceanfront homes. For instance most of the property owners in Litchfield By The Sea resort are investment and 2nd homes,

Pros:

- High Demand: Myrtle Beach is a popular tourist destination, which means that there is high demand for rental properties. This can result in steady rental income for the property owner.

- Potential for Appreciation: The value of the real estate in Myrtle Beach has been steadily increasing, providing potential for appreciation of the investment. Myrtle Beach was up almost 2% – YoY 2022 –> 2023. Charleston SC was up over 4%.

- Tax Benefits: Owning a rental property can provide tax benefits, such as deductions for mortgage interest, property taxes, and depreciation.

- Control Over the Property: As an investment property owner, you have complete control over the property and can make any improvements or updates as needed.

Cons:

- Carrying Costs: Buying a home or condo as an investment property involves carrying costs, such as mortgage payments, property taxes, insurance, HOA regime fees, and maintenance expenses. These costs can add up, reducing the net income generated by the property. Condos (SFA) are different than detached homes and have their risks.

- Risk of Vacancy: There is always the risk of vacancy, which means that the property may not generate rental income for a period of time. This can make it challenging to cover the carrying costs of the property.

- Property Management: Unless you are willing to manage the property yourself with a site like VRBO or HERE, you will need to hire a property management company, which can add to the expenses of owning the property.

- Maintenance Expenses: Properties require ongoing maintenance and repairs, which can add up over time and eat into the rental income generated by the property.

- Getting financing for condos can also be far more difficult to achieve than purchasing a detached property.

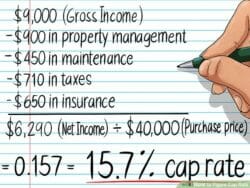

When it comes to calculating the financials of owning a rental property, it’s important to take into account the gross income (rental income before expenses), net income (rental income after expenses), and carrying costs (expenses related to owning the property). A useful tool to determine if a property is a good investment is the cap rate, which is the ratio of net income to the property’s value. A cap rate of 5% or higher is generally considered a good return on investment.

(rental income before expenses), net income (rental income after expenses), and carrying costs (expenses related to owning the property). A useful tool to determine if a property is a good investment is the cap rate, which is the ratio of net income to the property’s value. A cap rate of 5% or higher is generally considered a good return on investment.

In conclusion, owning a home or condo as an investment property in Myrtle Beach, Isle of Palms, Wild Dunes, Kiawah Island, Edisto Beach, or anywhere in coastal South Carolina can be a lucrative opportunity, but it’s important to carefully consider the pros and cons, carrying costs, and potential risks before investing. As with any investment, it’s always a good idea to consult with a financial advisor to ensure that the investment aligns with your overall financial goals and strategy.